Are you looking for a way to save on taxes and grow your retirement savings? A Backdoor Roth IRA might be the solution. This tax strategy allows high-income earners who are ineligible for traditional IRAs to convert their after-tax contributions into tax-free savings. By taking advantage of this option, you can maximize your long-term financial security while minimizing your annual tax burden. In this article, we’ll explain the differences between a traditional IRA and a Roth IRA, the advantages of a Backdoor Roth IRA, and why you should consider one as part of your tax planning strategy.

Roth and Traditional IRAs are two of the most popular retirement savings accounts. While both offer tax advantages, they also have key differences that you should be aware of before deciding which account is best for your financial situation. One of the primary differences between a Roth IRA and a Traditional IRA is how taxes are handled on contributions and withdrawals. With a traditional IRA, contributions may be tax-deductible in the year they’re made; however, any earnings or withdrawals from the account will be taxed at ordinary income rates in retirement. Alternatively, with a Roth IRA, contributions are not deductible but all qualified withdrawals—including earnings—are completely tax-free after age 59 1/2 as long as you’ve had your Roth account open for more than five years (known as “the five-year rule”). This makes it an attractive option if you anticipate being in a higher tax bracket during retirement than when making contributions to your account now.

A backdoor Roth IRA is an tax strategy that allows individuals to contribute to a Roth IRA even if their income exceeds the eligibility limits. It consists of two steps: first, you make a nondeductible contribution to a Traditional IRA and then convert it into a Roth IRA. This can be done regardless of how much money you make each year, making it an attractive option for high earners who are looking for ways to lower their tax liability and grow their retirement savings.

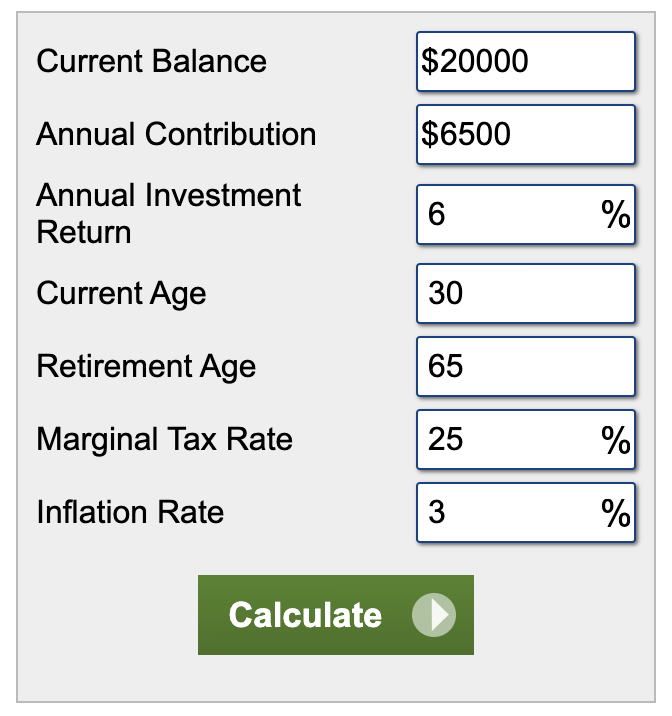

The first step in setting up a backdoor Roth IRA is to make a nondeductible contribution to your Traditional IRA account. The amount you are allowed to contribute depends on your age—if you’re under 50, the maximum annual contribution limit is $6,000; if you’re over 50, the limit increases to $7,000 per year. Once you have made the contribution, wait until after April 15th of that year before beginning the conversion process from Traditional IRAs into a Roth account. Then contact your financial institution or broker and follow their instructions for completing the conversion process quickly and easily.

The biggest advantage of utilizing the backdoor Roth strategy is that all qualified withdrawals from your new Roth account (including earnings) will be completely tax-free after age 59 1/2 as long as you have had your account open for more than five years (known as “the five-year rule”). Furthermore, any earnings made on investments within your traditional IRA can also be moved over with no additional taxes due at conversion time since they were already taxed when contributed initially.

In conclusion, a Backdoor Roth IRA is an tax strategy that can help high-income earners maximize their retirement savings while minimizing taxes. With its potential to reduce your annual tax burden and increase long-term financial security, this accounting tactic should be considered as part of any comprehensive accounting or tax planning strategy.

This process will not work for all taxpayers, be sure to contact us to see how this might fit into your long-range financial plan.